Home / world / Trump Defends Sweeping Tariffs Amid Market Turmoil: “Sometimes You Have to Take the Medicine”

Trump Defends Sweeping Tariffs Amid Market Turmoil: “Sometimes You Have to Take the Medicine”

By: My India Times

5 minutes read 77Updated At: 2025-04-07

Washington, D.C. – April 7, 2025 — Former President Donald Trump has doubled down on his latest wave of sweeping tariffs, defending the controversial move as a necessary measure to restore American economic strength. Amid mounting global criticism and a staggering stock market downturn, Trump described the new policy as a tough but vital remedy for long-term prosperity.

“Sometimes you have to take the medicine to fix something,” Trump said during an impromptu press conference at Mar-a-Lago on Sunday. “We’re going to become a wealthy nation again—wealthy like never before.”

His remarks came just days after the announcement of reciprocal tariffs on virtually all U.S. trading partners, a bold escalation that has already triggered significant retaliation and rocked global financial markets.

Sweeping Tariff Policy Shocks Global Markets

Dubbed by critics as an “economic earthquake,” Trump’s tariff policy—unveiled last Wednesday—imposes a baseline 10% tariff on all imported goods. In some cases, specific countries face steeper penalties under retaliatory clauses for what Trump calls “years of abusive trade practices.”

The announcement immediately sent shockwaves through global stock exchanges. Wall Street suffered a historic two-day plunge, with the S&P 500 shedding over $5 trillion in market value by Friday’s close. The selloff marked the sharpest decline since the 2020 pandemic crash. In total, nearly $6 trillion has been wiped from the U.S. stock market in the past week.

European and Asian markets followed suit, with London’s FTSE, Germany’s DAX, and Japan’s Nikkei posting sharp losses. Commodity prices also slumped, while investors shifted billions into safe-haven assets such as U.S. Treasury bonds and gold.

Oil prices fell sharply, raising concerns about a possible global slowdown, as demand forecasts were slashed in response to expected trade disruptions and reduced industrial activity.

Trump Calls It a 'Liberation Day'

Despite the upheaval, Trump appeared unfazed. “I don’t want anything to go down,” he admitted, referencing the stock market plunge. “But this is about something much bigger. It’s about making America strong again, independent again. We’ve been getting ripped off by other countries for decades.”

Labeling the day of the tariff announcement as “Liberation Day,” Trump characterized the policy as a reclaiming of America’s economic sovereignty. “It’s a declaration that we will no longer tolerate unfair trade deals, intellectual property theft, and chronic trade imbalances,” he said.

Trump also dismissed concerns over the international backlash, noting that “lots of countries are dying to make a deal” with the U.S. under new terms.

Global Response: Shock, Condemnation, and Retaliation

World leaders and economic analysts have voiced deep concern over the potential fallout. The European Union issued a formal statement condemning the tariffs and vowed reciprocal measures targeting American goods ranging from agricultural products to industrial machinery.

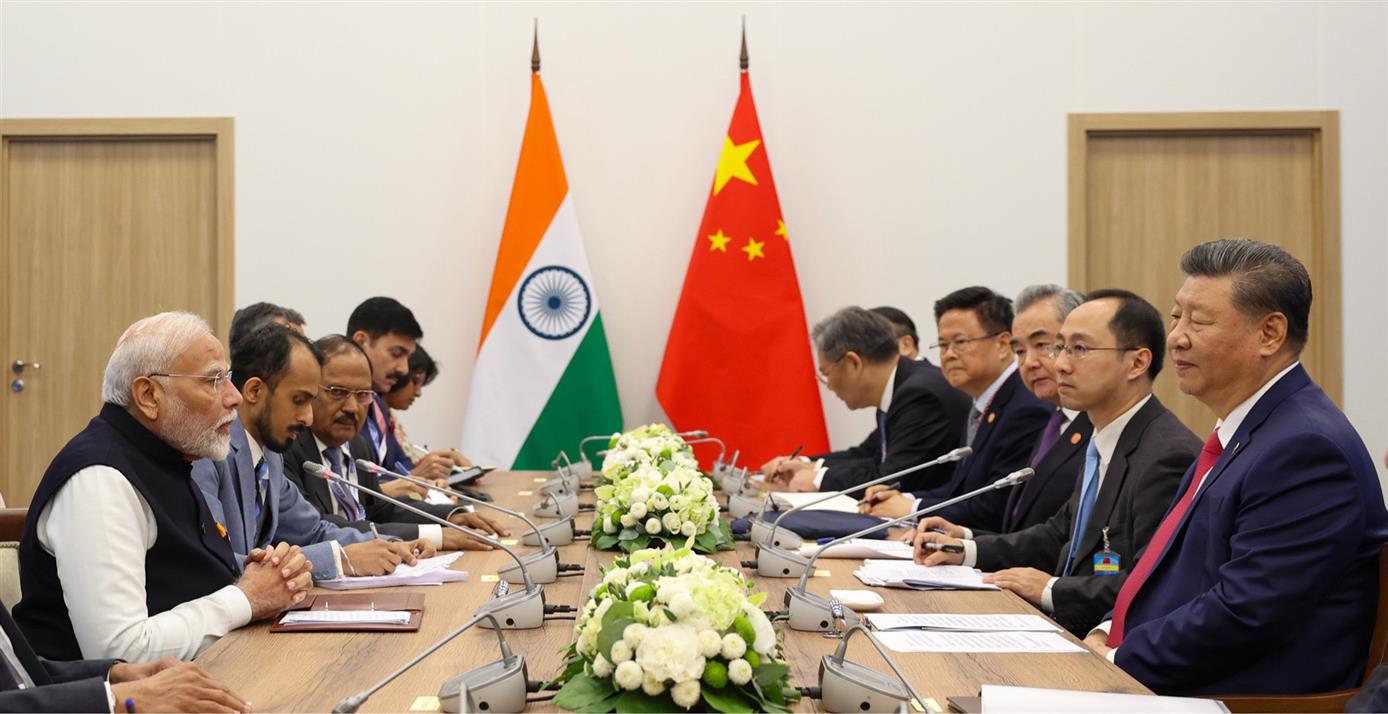

China responded within hours of the announcement, slapping tariffs on $120 billion worth of U.S. imports, including soybeans, automobiles, and aircraft components. Beijing called Trump’s move a “serious violation of international trade norms” and warned of “unpredictable consequences.”

Canada, Mexico, Japan, and South Korea have all issued statements expressing disappointment and concern, with some already signaling retaliatory action.

Even traditional allies like the United Kingdom and Australia, normally hesitant to criticize Washington, voiced frustration. British Prime Minister Ellie Sinclair said the policy “threatens the rules-based international trade system,” while Australia’s Trade Minister said it would “complicate global supply chains just as the world economy is attempting to stabilize.”

Economic Experts Raise Red Flags

Economists warn that a prolonged trade war could tip the global economy into a recession. According to an emergency report from the International Monetary Fund (IMF), the tariffs could reduce global GDP by up to 1.5% over the next year if sustained.

“The scope and scale of these tariffs are unlike anything seen in modern economic history,” said IMF Chief Economist Luisa Tanaka. “They introduce widespread uncertainty at a time when the global economy is already vulnerable.”

In the United States, corporate leaders from industries as varied as technology, agriculture, and manufacturing have raised alarms. Apple, Caterpillar, and Ford all released statements expressing concern about increased costs and disrupted supply chains. The U.S. Chamber of Commerce labeled the tariffs “an economic self-inflicted wound.”

Despite this, some sectors have seen short-term gains. Domestic steel and aluminum producers have experienced stock bumps amid speculation that reduced foreign competition will boost local output.

Political Divide Deepens

Trump’s latest economic gamble has further widened the political divide in Washington. Supporters within the Republican base praised the move as long overdue, with many in conservative media framing the tariffs as a defense of American workers and industries.

Senator Josh Hawley (R-MO) backed Trump’s approach, saying, “We’ve coddled global elites and ignored working-class Americans for too long. This is a reset.”

However, Democrats and a significant number of moderate Republicans were quick to condemn the decision. Senate Majority Leader Chuck Schumer said, “This isn’t a strategic policy. It’s a reckless economic tantrum that will hurt millions of American families.”

Progressives also noted the impact on consumer prices, warning that the tariffs could drive inflation higher at a time when many Americans are still struggling with the cost-of-living crisis.

What Comes Next?

With markets in turmoil and the global response growing fiercer by the day, the next few weeks are likely to be pivotal. Trump has signaled he is open to negotiations—but only if foreign governments agree to what he calls “fair, patriotic deals.”

“We’re open for business,” Trump said Sunday. “But this time, it’s going to be business that benefits America first.”

Analysts say much will depend on how long the standoff continues and whether major trading partners are willing to come to the negotiating table. In the meantime, businesses are bracing for prolonged disruption, and investors are watching nervously for the market’s next move.

For now, Trump remains resolute, betting that a short-term shock will pave the way for a long-term revival. “It’s not easy,” he said. “But when the dust settles, we’re going to be better, stronger, and richer than ever.”

....Washington, D.C. – April 7, 2025 — Former President Donald Trump has doubled down on his latest wave of sweeping tariffs, defending the controversial move as a necessary measure to restore American economic strength. Amid mounting global criticism and a staggering stock market downturn, Trump described the new policy as a tough but vital remedy for long-term prosperity.

“Sometimes you have to take the medicine to fix something,” Trump said during an impromptu press conference at Mar-a-Lago on Sunday. “We’re going to become a wealthy nation again—wealthy like never before.”

His remarks came just days after the announcement of reciprocal tariffs on virtually all U.S. trading partners, a bold escalation that has already triggered significant retaliation and rocked global financial markets.

Sweeping Tariff Policy Shocks Global Markets

Dubbed by critics as an “economic earthquake,” Trump’s tariff policy—unveiled last Wednesday—imposes a baseline 10% tariff on all imported goods. In some cases, specific countries face steeper penalties under retaliatory clauses for what Trump calls “years of abusive trade practices.”

The announcement immediately sent shockwaves through global stock exchanges. Wall Street suffered a historic two-day plunge, with the S&P 500 shedding over $5 trillion in market value by Friday’s close. The selloff marked the sharpest decline since the 2020 pandemic crash. In total, nearly $6 trillion has been wiped from the U.S. stock market in the past week.

European and Asian markets followed suit, with London’s FTSE, Germany’s DAX, and Japan’s Nikkei posting sharp losses. Commodity prices also slumped, while investors shifted billions into safe-haven assets such as U.S. Treasury bonds and gold.

Oil prices fell sharply, raising concerns about a possible global slowdown, as demand forecasts were slashed in response to expected trade disruptions and reduced industrial activity.

Trump Calls It a 'Liberation Day'

Despite the upheaval, Trump appeared unfazed. “I don’t want anything to go down,” he admitted, referencing the stock market plunge. “But this is about something much bigger. It’s about making America strong again, independent again. We’ve been getting ripped off by other countries for decades.”

Labeling the day of the tariff announcement as “Liberation Day,” Trump characterized the policy as a reclaiming of America’s economic sovereignty. “It’s a declaration that we will no longer tolerate unfair trade deals, intellectual property theft, and chronic trade imbalances,” he said.

Trump also dismissed concerns over the international backlash, noting that “lots of countries are dying to make a deal” with the U.S. under new terms.

Global Response: Shock, Condemnation, and Retaliation

World leaders and economic analysts have voiced deep concern over the potential fallout. The European Union issued a formal statement condemning the tariffs and vowed reciprocal measures targeting American goods ranging from agricultural products to industrial machinery.

China responded within hours of the announcement, slapping tariffs on $120 billion worth of U.S. imports, including soybeans, automobiles, and aircraft components. Beijing called Trump’s move a “serious violation of international trade norms” and warned of “unpredictable consequences.”

Canada, Mexico, Japan, and South Korea have all issued statements expressing disappointment and concern, with some already signaling retaliatory action.

Even traditional allies like the United Kingdom and Australia, normally hesitant to criticize Washington, voiced frustration. British Prime Minister Ellie Sinclair said the policy “threatens the rules-based international trade system,” while Australia’s Trade Minister said it would “complicate global supply chains just as the world economy is attempting to stabilize.”

Economic Experts Raise Red Flags

Economists warn that a prolonged trade war could tip the global economy into a recession. According to an emergency report from the International Monetary Fund (IMF), the tariffs could reduce global GDP by up to 1.5% over the next year if sustained.

“The scope and scale of these tariffs are unlike anything seen in modern economic history,” said IMF Chief Economist Luisa Tanaka. “They introduce widespread uncertainty at a time when the global economy is already vulnerable.”

In the United States, corporate leaders from industries as varied as technology, agriculture, and manufacturing have raised alarms. Apple, Caterpillar, and Ford all released statements expressing concern about increased costs and disrupted supply chains. The U.S. Chamber of Commerce labeled the tariffs “an economic self-inflicted wound.”

Despite this, some sectors have seen short-term gains. Domestic steel and aluminum producers have experienced stock bumps amid speculation that reduced foreign competition will boost local output.

Political Divide Deepens

Trump’s latest economic gamble has further widened the political divide in Washington. Supporters within the Republican base praised the move as long overdue, with many in conservative media framing the tariffs as a defense of American workers and industries.

Senator Josh Hawley (R-MO) backed Trump’s approach, saying, “We’ve coddled global elites and ignored working-class Americans for too long. This is a reset.”

However, Democrats and a significant number of moderate Republicans were quick to condemn the decision. Senate Majority Leader Chuck Schumer said, “This isn’t a strategic policy. It’s a reckless economic tantrum that will hurt millions of American families.”

Progressives also noted the impact on consumer prices, warning that the tariffs could drive inflation higher at a time when many Americans are still struggling with the cost-of-living crisis.

What Comes Next?

With markets in turmoil and the global response growing fiercer by the day, the next few weeks are likely to be pivotal. Trump has signaled he is open to negotiations—but only if foreign governments agree to what he calls “fair, patriotic deals.”

“We’re open for business,” Trump said Sunday. “But this time, it’s going to be business that benefits America first.”

Analysts say much will depend on how long the standoff continues and whether major trading partners are willing to come to the negotiating table. In the meantime, businesses are bracing for prolonged disruption, and investors are watching nervously for the market’s next move.

For now, Trump remains resolute, betting that a short-term shock will pave the way for a long-term revival. “It’s not easy,” he said. “But when the dust settles, we’re going to be better, stronger, and richer than ever.”

By: My India Times

Updated At: 2025-04-07

Tags: world News | My India Times News | Trending News | Travel News

Join our WhatsApp Channel

.png)

.png)

.jfif)

.png)

(1).png)